Not surprisingly, consistent with our standard approach to pollution control, most climate policy proposals focus on the goal of reducing greenhouse gas emissions. While that is unquestionably the end game, confronting climate change will require transformation in all emitting sectors. The goal, then, is not just “reducing greenhouse gases,” but transitioning to a clean economy. How we frame the goal affects our assessment of carbon pricing as a policy mechanism.

Carbon pricing does not dictate reductions; it lets regulated entities decide whether to reduce emissions or, instead, pay a carbon tax or purchase allowances or offsets. As a result, a carbon price does not ensure that change is occurring to the degree and in the sectors necessary for a transition to clean energy.

For example, in jurisdictions with comprehensive cap-and-trade programs, entities in some sectors might make the majority of the reductions, and entities in other sectors might disproportionately purchase allowances. In that case, even assuming the emissions cap is met, the allowance-purchasing sector would not be progressing toward decarbonization.

|

Uneven responses to a market signal could fail to spur transformative change across all emitting sectors. |

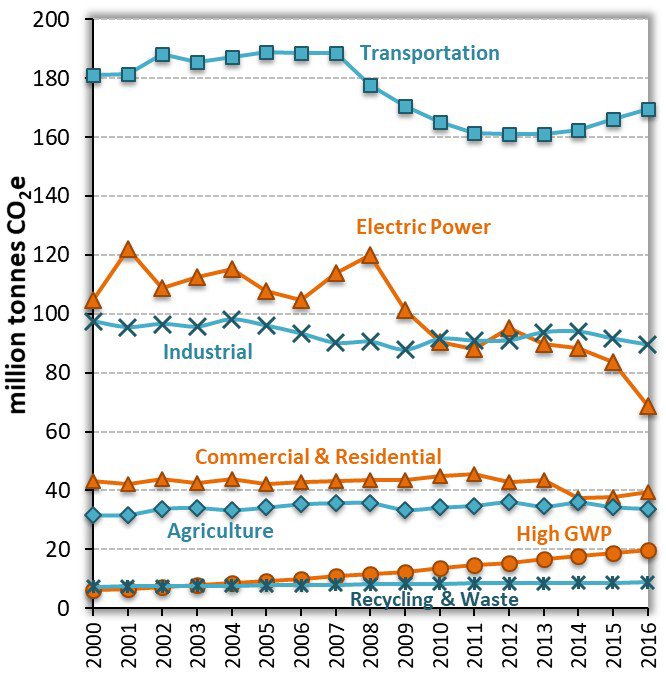

This pattern may be playing out under California’s cap-and-trade program. To date, most emissions reductions have occurred in the electricity and transportation sectors, driven, at least in part, by an increasingly stringent renewable portfolio standard, efficiency standards, and automobile sector requirements (although transportation emissions have recently increased). In contrast, industrial emissions have decreased quite modestly.[i] It is possible that industry is purchasing allowances, allowances that are readily available and inexpensive because the electricity and transportation sectors require disproportionately fewer allowances due to direct emission reduction requirements. As a consequence, the flexibility offered by a cap-and-trade program may be allowing industry to delay or avoid transitioning to clean technology. There may be legitimate concerns about pressuring industry, like the risk that expensive requirements would push industry out-of-state, resulting in economic harm with no environmental benefit. Nonetheless, an effective climate policy will need to take the measures necessary to prompt change in all sectors, whether through carrots or sticks, rather than accepting the status quo in certain sectors or industries.

Moreover, some cap-and-trade programs allow regulated entities to cover their emissions with carbon offsets.[ii] Assuming the validity and legitimacy of the offset, a utility or industrial facility using offsets would be properly accounting for its emissions, even if it did not directly reduce emissions. From a global carbon perspective, it is immaterial whether the regulated facility itself reduces its emissions or the offset-generating entity does so. In either case, the immediate emissions cap can, at least theoretically, be met. However, to the degree facilities, sectors, or nations rely on offsets, they are relying on others to reduce emissions, not transitioning themselves.

Moreover, some cap-and-trade programs allow regulated entities to cover their emissions with carbon offsets.[ii] Assuming the validity and legitimacy of the offset, a utility or industrial facility using offsets would be properly accounting for its emissions, even if it did not directly reduce emissions. From a global carbon perspective, it is immaterial whether the regulated facility itself reduces its emissions or the offset-generating entity does so. In either case, the immediate emissions cap can, at least theoretically, be met. However, to the degree facilities, sectors, or nations rely on offsets, they are relying on others to reduce emissions, not transitioning themselves.

Market’s Capacity to Manage Structural Change

Given utilities’ structural incentives, a carbon price could fail to incentivize optimal results. For example, because most utilities depend on selling electricity to bring in revenue, utilities have an incentive to focus primarily on supply options, like low-carbon generation. They would be less likely to promote energy efficiency and other mechanisms to reduce consumer demand. A government role in requiring appliance and building efficiency, as well as other innovative demand management mechanisms,[iii] could be necessary to counter utilities’ institutional preference for supply-side options that maintain their revenue and business model.

And, going deeper, transitioning to clean electricity calls into question the structure of existing utilities and their regulation. Renewable energy and energy efficiency create new opportunities and possibilities for the structure of the electricity sector itself.[iv] The existing system assumes centralized fossil-fuel combustion. Decentralized renewable energy, whether rooftop solar or community-based solar or wind generation, creates new opportunities. The role of utilities in the future of electricity, as well as the structure of utility regulation,[v] is contested and unclear. A carbon price, on its own, cannot address these institutional and regulatory issues.

The Price is Right – or Not?

Carbon prices in existing carbon cap-and-trade programs and carbon taxes have not been meaningless, but they have not been strong enough to induce necessary innovation. A recent economic analysis suggests that the carbon prices needed to meet the objectives of the Paris Agreement on Climate Change are in the range of $40 to $80 per ton of carbon dioxide by 2020, and $50 to $100 per ton by 2030.[vi]

|

Carbon prices in existing cap-and-trade programs have not been strong enough to induce necessary innovation. |

Most existing carbon pricing programs have fallen far short of that level. The European Union’s Emissions Trading System has historically had very low prices, often under 10 euros (about $11) per ton, though prices increased into the low 20 euros per ton in 2018 and 2019.[vii] Despite efforts to tighten allowance supply, allowance prices in the northeastern states’ cap-and-trade program for electric utilities (the Regional Greenhouse Gas Initiative (RGGI) have been well under $10 per ton.[viii] As of February 2019, the auction price for California allowances in its cap-and-trade program was just over $15 per ton.[ix] These prices are unlikely to induce the necessary level of transformational innovation.

Canada’s carbon pricing mechanisms are more ambitious. As of April 1, 2019, all provinces must have a carbon pricing mechanism. Provinces with preexisting mechanisms can continue their programs, while provinces without their own pricing programs are subject to a federal tax on oil, coal, and gas.[x] The New York Times reports that, in U.S. dollars, the current prices range from $15 to $30 per ton ($15/ton under the federal tax), and the price is expected to rise to $38/ton by 2022.[xi]

Ultimately, it is not clear that injecting the high prices needed to spark innovation is politically feasible or desirable without substantial steps to address their socioeconomic consequences. The Canadian taxes address this concern by giving revenue back to residents and industries at risk of international competition. Even so, high taxes face intense political pressure. And, unless their impacts are addressed, they are regressive, affecting the poor, who pay a disproportionate share of their income on energy, more than the rich. Having a carbon price is important. But imposing an extreme price and forcing change through that price would be a risky and brutal mechanism for inducing the full measure of necessary change.

Endemic Uncertainty

Both a carbon tax and cap-and-trade create systemic uncertainties. With a carbon tax, on its own, only price is controlled, not emission reductions. Policy analysts can do their best to model the impacts of differing tax levels, but determining how a tax would affect actual emission levels will always be guesswork, subject to the vagaries of cost curves and demand. Policymakers could adjust the tax if it appears insufficient, but frequent adjustments would undermine the economic predictability considered one of a carbon tax’s key virtues.

|

Carbon taxes generate uncertain carbon reductions, and cap-and-trade programs create uncertain carbon prices. |

A cap-and-trade program provides more certain emission reductions, assuming the cap is met. But the transformative incentives created by the program are uncertain. If economic growth is strong and demand is high, then allowance demand and prices will be correspondingly high, creating strong incentives for low-carbon choices. But if economic growth is weak or decreasing, as was the case in the most recent recession, then emissions will be lower, and the cap could be met with little transformational effort.

Of course, more systematic measures to achieve a clean energy transition, including some level of planning for electricity, transportation, and land use shifts, do not guarantee results; the history of environmental law is a mixed bag, with great successes and its share of unmet goals. Nonetheless, deliberative planning and specific implementation measures could provide a structure for change that would be less uncertain than relying exclusively on a tax or a cap and then crossing ones fingers that the hoped-for transformation will occur.

[i] California Air Resources Board, California Greenhouse Gas Emissions for 2000 to 2016 (Figure 2, Trends in California GHG Emissions, page 4), https://www.arb.ca.gov/cc/inventory/pubs/reports/2000_2016/ghg_inventory_trends_00-16.pdf.

[ii] See California Air Resources Board, Compliance Offset Program, https://www.arb.ca.gov/cc/capandtrade/offsets/offsets.htm (last visited March 8, 2019); The Regional Greenhouse Gas Initiative, Offsets, https://www.rggi.org/allowance-tracking/offsets (last visited March 8, 2019). At the international level, the Kyoto Protocol includes the “Clean Development Mechanism,” which allows developed country parties (primarily European countries) to purchase emission reduction credits representing emission reductions from developed countries. See UNFCC, The Clean Development Mechanism, https://unfccc.int/process-and-meetings/the-kyoto-protocol/mechanisms-under-the-kyoto-protocol/the-clean-development-mechanism (last visited March 8, 2019).

[iii] Twenty states have energy efficiency resources standards that require utilities to achieve energy efficiency standards. Database of State Incentives for Renewables & Efficiency, U.S. Dep’t of Energy, Energy Efficiency Resource Standards (and Goals) (Oct. 2016), http://ncsolarcen-prod.s3.amazonaws.com/wp-content/uploads/2016/10/Energy-Efficiency-Resource-Standards.pdf. Numerous other state policies promote energy efficiency. Weston Berg, et al., American Council for an Energy-Efficient Economy, The 2018 State Energy-Efficiency Scorecard (Oct. 2018).

[iv] See Joseph Tomain, Clean Power Politics: The Democratization of Energy (2017).

[v] To counter this risk, just over half the states have adopted “Energy Efficiency Resources Standards,” which require utilities to encourage greater consumer efficiency. American Council for an Energy Efficient Economy, State and Local Policies: Energy Efficiency Resource Standards, https://database.aceee.org/state/energy-efficiency-resource-standards. Slightly less than half the states have “decoupled” utility profits from electricity sales to reduce the disincentive to encourage energy efficiency. Center for Climate and Energy Solutions, Decoupling Policies, https://www.c2es.org/document/decoupling-policies/.

[vi] Carbon Pricing Leadership Coal., Report of the High-Level Commission on Carbon Prices 5 (2017).

[vii] CO2 European Emission Allowances Price Chart, Markets Insider, https://markets.businessinsider.com/commodities/historical-prices/co2-emissionsrechte/euro/7.3.2005_7.4.2019 (visited April 7, 2019).

[viii] The Regional Greenhouse Gas Initiative, Allowance Prices and Volumes, https://www.rggi.org/auctions/auction-results/prices-volumes (visited April 7, 2019).

[ix] California Air Resources Board, California Cap-and-Trade Program, Summary of California-Quebec Joint Auction Settlement Prices and Results (Feb. 2019), https://www.arb.ca.gov/cc/capandtrade/auction/results_summary.pdf.

[x] Government of Canada, Implementing Canada’s Plan to Address Climate Change and Grow the Economy, https://www.arb.ca.gov/cc/capandtrade/auction/results_summary.pdf (visited April 7, 2019); Kathryn Harrison, Here’s What the Carbon Tax Means for You, The Conversation (April 2, 2019).

[xi] Brad Plumer & Nadja Popovich, These Countries Have Prices on Carbon. Are They Working? The New York Times (April 2 2019).